Jubilant Foods

Had been watching Jubilant Foods Ltd since last 15 days for a right entry.

While the NIFTY was rising with volatility Jube kept itself range bound.

The box in the chart below shows the area where Jube was range bound compared to NIFTY.

[Click on the chart to Enlarge]

On 21st September I saw strength formation in Jube. The MACD crossed up zero and stochastic its 50 line comfortably. While there was a negative DMI cross of ADX, the ADX strength line itself was below the 20 line indicating that it was not in a trend and that Oscillators should be followed in such times.

The chart below shows the strength that the Oscillators were forming

[Click on the chart to Enlarge]

The next step was to peep into volume based indicators. I had a look into the Intra-day Intensity Index and it had comfortably entered positive levels. Below is the Intra-day Intensity chart.

[Click on the chart to Enlarge]

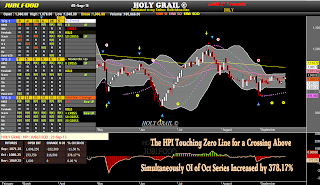

Next I peeped into the Herrick Payoff Index. The HPI was just about to cross its zeo line from below. The Oct series Open Interest Spurted. Below is the HPI chart.

I got the confirmations that the move was around the corner. I decided to enter on a long side on 23th Sep in the early morning trades. I knew the Index would fall again, but I was convinced to enter the trade in Jube.

Here is what happened with Jube on 23rd Sep

[Click on the chart to Enlarge]

The chart below shows how the core strength developed in Jube irrespective of the Index movement

[Click on the chart to Enlarge]

LESSON : When the Core Strength of any stock comes in it moves irrespective of the INDEX.